It’s been months since President Biden signed the American Rescue Plan Act (ARPA) into law. The $1.9 trillion package relieves millions of families, schools, businesses, local and state governments struggling amid the pandemic. The catch, though, it’s temporary – lasting only up to the 2022 plan year. Hopefully, you’re leveraging the increased financial assistance. If not, we (HST agents) want to stress just how substantial this assistance can be for you.

The ARPA law includes a broad expansion of the premium tax credit (PTC), forming its first major expansion since its passage. Its provisions include comprehensive yet affordable insurance coverage. It reduces the percentage of income that families and individuals pay as premiums, consequently increasing their available PTCs.

As Kaiser Health News (KHN) denotes:

“How much people owe is reduced at every income level and capped at 8.5% overall.”

Here’s a summary of the main changes.

One: zero-dollar premiums for incomes below 150% of the FNL

According to CMS, ARPA:

“increases premium tax credits for all income brackets for coverage years beginning in 2021 and 2022.”

But as KHN explains, individuals with income levels below 150% of the federal poverty level (FPL) – that’s around $19,140 per year for a single person:

“will owe nothing in premiums. The Affordable Care Act required them to pay up to 4.14% of their household income as their share of the premium cost.”

That provides these individuals and families with a fully paid-for benchmark silver plan.

Two: 8.5% overall premiums for incomes 300 and 400% of the FNL

Flipping the income spectrum to individuals with incomes between 300 and 400% of the FNL, CMS notes:

“No one will pay more than 8.5% of their household income towards the cost of the benchmark plan or a less expensive plan.”

The benchmark plan refers to the second-lowest priced silver-level plan in the marketplace. As the name suggests, it’s used to determine the PTC amount. Before the President signed ARPA into law, administrations used a sliding scale (up to 9.83% of household income) to determine the capped amount.

Thus, a family earning around 300% of the FPL will have their applicable percentage fall from 9.83% to 6% – under the new premium schedule.

Three: elimination of “subsidy cliff” for incomes above 400% of the FNL

The American Rescue Plan Act qualifies individuals and families earning above 400% of the FPL for PTCs for the first time.

As CMS explains, the “subsidy cliff” for individuals earning over 400%of the FPL is eliminated, requiring them to pay no more than 8.5% of their income for the benchmark plan. This financial assistance can save these individuals and families thousands of dollars.

For example, a 59-year-old earning $58,000 per year (approximately 450% of the FPL) has their premiums lowered from $12,900 to $4,950 per year.

Four: The case for unemployment benefits

Finally, KNH notes:

“Anyone who has received unemployment benefits this year will be considered to have income at 133% of the federal poverty level (about $17,000) to calculate how much they owe in premium contributions for a marketplace plan.”

That automatically put people collecting unemployment in the same class as those earning below 150% of the FPL. They, therefore, can get $0 premium silver plans.

Section 9663 of the ARPA ensures that nearly every unemployed worker who receives unemployment compensation for at least one week in 2021 will obtain a PTC with zero-dollar premiums. Section 2305 of the same law ensures the silver plan also includes cost-sharing reductions – bringing the actuarial value of the silver plan to 94%. That’s superior to the value of the Platinum plan.

Determining the cost-sharing eligibility and PCT amount will disregard any income above 133% of the FPL. Eligible enrollees must attest to the fact that they’ve or are receiving unemployment benefits in 2021. (The HHS will give guidelines on what documents can serve as proof.)

(If at some point in 2021 you become eligible for an affordable and minimum value employer-sponsored health insurance, you’ll no longer be eligible for cost-sharing deductions and premium subsidies. The same goes for your family members eligible to join the employer-sponsored health insurance.)

It’s important to note that some states require abortion coverage on all PCT plans. There are other states where insurance carriers voluntarily include abortion coverage in the policy. Thus, the after-subsidy premiums cannot reduce below $1/month. Sometimes, the minimum premium deductions are above the $1/month. The ARPA has not altered this. That means there are a few states where those receiving unemployment benefits in 2021 will still pay some premiums for their silver plan.

So while the ARPA does not:

- Expand the ACA’s cost-sharing subsidies

- Include PTC eligibility for people provided employer-sponsored coverage

- Include the “family glitch.”

- Change rules for undocumented immigrants currently ineligible for premium tax credits.

ARPA temporarily makes insurance premiums affordable for most Americans while laying a foundation for:

- States to reevaluate affordability barriers

- Permanent and broader federal improvements

The Numbers

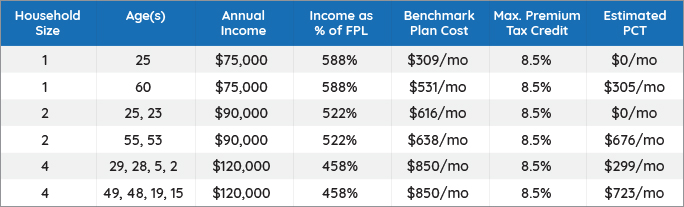

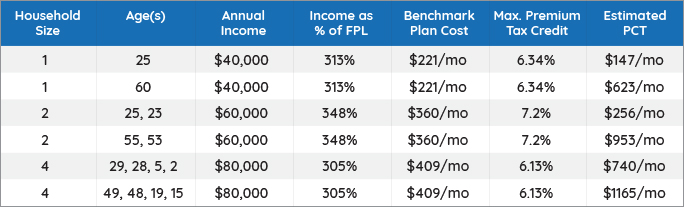

While it’s one thing to hear about enhanced PTCs, it makes more sense to see some examples.

Below are calculations for available PTCs for different ages, annual income levels, and family sizes.

(We calculated the tabulated data using the Kaiser Family Foundation Premium Tax Calculator. We used Lombard, Illinois as the location.)

The benchmark plan cost is the cost of the silver-level plan after applying the PCT. We recorded the estimated financial help. But you can determine the actual amount of the PTC by visiting your state’s Health Insurance Marketplace or Healthcare.gov.

People with similar household sizes and income levels are capped at equal amounts of the benchmark plan. However, the estimated PTC (financial help) is higher for older people. Young individuals with high incomes are not eligible for any PTCs if their premium deductions are under the capped amount.

Income below 400% of FPL

Income above 400% of FPL (no cap before ARPA)