National General Access Health Plan

What is the National General Insurance Access Plan?

National General’s Access Plan gives you an affordable and predictable way to help pay for preventive care, hospital stays, surgeries, X-rays, labs, and more. You can sign up any time you like, with next-day effective dates.

There are no deductibles or copays to satisfy. This plan pays set dollar amounts when you receive covered services. Any costs that exceed the benefit amount are your responsibility.

Combine National General Access with a Short Term Medical or major medical plan to build a more complete coverage solution that will help you keep your health and wellness strong.

What is a Fixed-Benefit or Limited-Medical Insurance Plan?

Fixed-benefit or limited-medical insurance is a type of insurance that pays a predetermined benefit amount based on the type of service provided or the time period during which the care is received. The same benefit is paid for the covered service regardless of the actual cost of the service. The benefit amount can be paid directly to you or to your provider. You are responsible for paying any costs that exceed the benefit amount.

Fixed-benefit or limited-medical insurance is not major medical insurance. These plans are not subject to all the requirements of the Affordable Care Act, and do not provide coverage for all the essential health benefits, may exclude pre-existing conditions, and may have service benefit limits, annual benefit limits, and lifetime benefit limits. These plans do not cap your out-of-pocket costs.

Fixed-benefit or limited-medical insurance is best when used in combination with a major medical plan. It can also be a minimum coverage option to offer assistance with health care costs if major medical is not affordable. This type of supplemental insurance can help you pay out-of-pocket costs for covered services.

What are the Highlights of the National General Insurance Access Plan?

Predictable, Set-Dollar Benefits

You’ll know exactly what the plan will pay to your provider for each covered office visit, test, hospitalization, and more. Then combine this with network discounts to help you stretch your benefits further. Any costs that exceed the benefit amount are the customer’s responsibility.

Benefits that Increase as You Go

Select benefits will increase with each consecutive year for up to three years. You can apply at any time during the year and the plan is auto-renewable, so you don’t have to re-enroll.

No Lifetime Maxium

There’s no overall lifetime maximum on your benefits, except for the Guaranteed Issue option.2 You get the same yearly benefits no matter how long you have your plan.

Here’s how you use it.

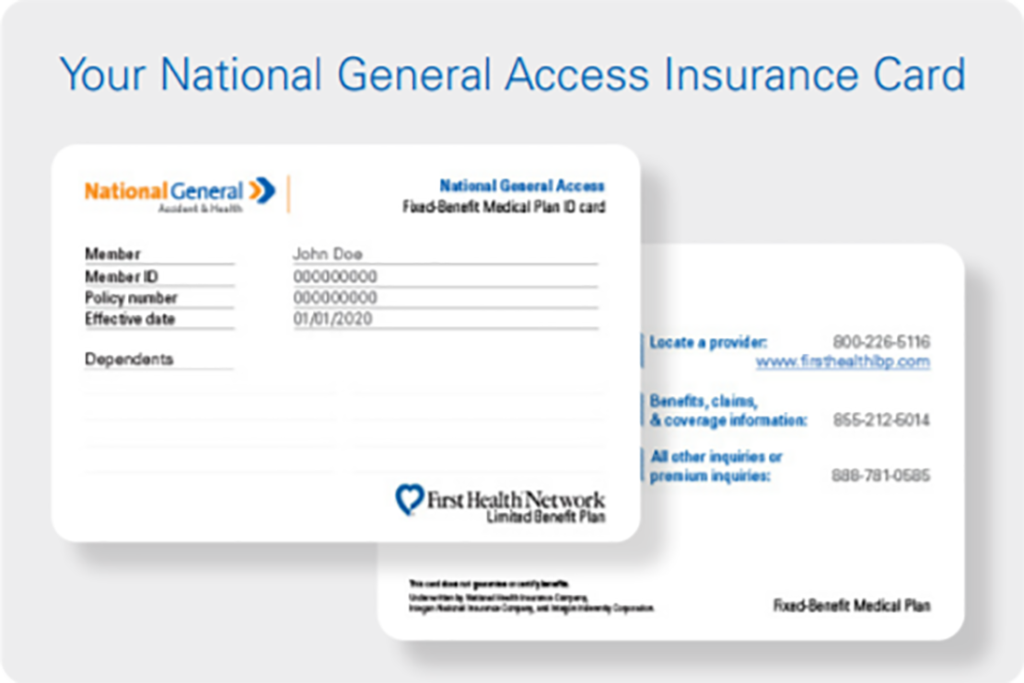

1. Present your insurance card at the time of service. No need to file any forms. Your health care provider will let us know which services you received.

2. The plan then pays your provider directly. If the services cost more than the amount of the benefit, you will be responsible for the remaining costs.

Prescription claims:

Pay for your prescription, then submit a claim form with photocopy of the receipt showing the drug, prescription number, quantity, and cost. Reimbursement will be paid directly to you.

How does it work?

Here’s an example:

Let’s say you have an accident and dislocate your shoulder. You then go to the Emergency Room and get an X-ray. Here’s how National General Access benefits would pay and help you reduce your costs:

EXAMPLE: Visit to the ER with an X-ray.

| X-RAY FEE: | $110 |

|---|---|

| EMERGENCY ROOM FEE: | $925 |

| NETWORK DISCOUNT: | - $390 |

| TOTAL INITIAL HOSPITAL CHARGES: (Less an Average Network Discount for First Health Network Providers) | $645 |

Fundamental Level benefits

| RADIOLOGY BENEFIT: | - $250 |

|---|---|

| EMERGENCY ROOM FEE: | -$250 |

| TOTAL BENEFITS: | - $500 |

| TOTAL COST TO YOU: | $145 |

National General Access Plan FAQs

About National General Insurance

National General Holdings Corp. (NGHC), headquartered in New York City, is a specialty personal lines insurance holding company. National General traces its roots to 1939, has a financial strength rating of A+ (Superior) from A.M. Best, and provides personal and commercial automobile, homeowners, umbrella, recreational vehicle, motorcycle, lender-placed, supplemental health, and other niche insurance products.

National General Accident & Health, a division of NGHC, is focused on providing supplemental and short-term coverage options to individuals, associations and groups. Products are underwritten by National Health Insurance Company (incorporated in 1965), Integon National Insurance Company (incorporated in 1987), and Integon Indemnity Corporation (incorporated in 1946). These three companies, together, are authorized to provide health insurance in all 50 states and the District of Columbia. National Health Insurance Company, Integon National Insurance Company, and Integon Indemnity Corporation have been rated as A+ (Superior) by A.M. Best. Each underwriting company is financially responsible for its respective products.